Introduction to Recruiting Metrics FAQ

Recruiting metrics are key performance indicators (KPIs) that measure the effectiveness of recruitment process. They include quality of hire, cost per hire, time to fill, source of hire, and offer acceptance rate. They provide insights into the quality, cost, and productivity of your hiring process.

- What does KPI mean in recruitment?

- What are recruiting metrics?

- What can you learn from recruitment metrics?

- Which are the most important metrics to track?

- How can I have better visibility into recruiting metrics?

- Who should be tracking recruiting metrics?

- How do I calculate recruiting metrics?

- What metrics should matter most to a Talent Acquisition team?

- Which metrics should matter most to an external recruiter?

- What metrics should matter most to HR?

- Which recruiting metrics matter most to the CEO?

- What metrics should I track when working with an external recruiter?

- How do I increase the number of job applicants?

- How do I increase the number of qualified applicants?

Intro to Recruiting Email Metrics

- Recruiting costs FAQ: Budget and cost per hire

- Time to fill and time to hire metrics FAQ

- Recruitment process effectiveness metrics FAQ

- Candidate experience metrics FAQ

- Job offer acceptance rate metrics FAQ

Intro to Recruiting Metrics

What does KPI mean in recruitment?

KPI stands for Key Performance Indicator and it can be used in any field or business function to measure performance. In recruitment, key recruiting metrics refer to the important factors related to the hiring process that you should consistently examine. For example, the speed with which hiring teams make a decision may be a KPI for a company that values quick turnaround and does mass hiring.

What are recruiting KPIs?

How do you measure success in recruitment? Recruiting KPIs (or hiring metrics) measure how effective and efficient your recruitment process is. Some metrics are expressed as percentages or ratios (e.g. yield ratios), while others are absolute values that you can compare to industry or company standards (e.g. time to hire.) Use them to discover how well your recruitment process works and identify where you could improve.

What can you learn from recruitment metrics?

Recruitment metrics can answer any question you want them to. At a high level, you probably want to know the quality, cost and productivity of your hiring process. More specifically, you could ask the following questions:

- How good are we at spotting the right candidate and how long does it take us to hire them?

- How many qualified candidates do we need to make a hire and how quickly do we move them from one stage to the other?

- Do we effectively engage the best candidates and getting them to accept our job offers?

- How much money do we spend per hire and how does our spending change depending on the role we’re hiring for?

- How efficient is our hiring process and which steps or stages are most productive?

Which are the 6 most important hiring metrics to track?

There are many available KPIs, but what are some common recruiting metrics? Usually, companies choose to track the following recruiting metrics examples:

- Quality of hire

- Cost per hire

- Recruiting yield metrics

- Time to fill

- Source of hire

- Offer acceptance rate

If you want to dig deeper recruiting metrics that matter, add metrics like application completion rate, hiring manager satisfaction or new hire turnover. Choose metrics based on your company’s individual needs.

How can I have better visibility into the best recruiting metrics??

Most recruiting metrics are easy to calculate, but hard to keep track of. The first step is to determine what kind of data you need to monitor. Then, you could invest in an Applicant Tracking System (ATS) to track your preferred metrics automatically via a recruiting metrics dashboard and generate reports. Alternatively, business intelligence tools (e.g. Tableau) can collect the recruiting analytics you need.

Looking for better reporting analytics? Workable’s reports will refine your recruiting process. Sign up for our 15-day free trial.

Who should be tracking recruiting metrics?

Recruiters or HR are usually in charge of tracking recruitment metrics. If your company doesn’t have a dedicated recruiting team, executives could monitor metrics for their respective departments and functions. Hiring software, like an HRIS or ATS, can help you collect relevant data.

How do I calculate recruiting metrics?

To calculate various recruiting metrics, use the following process:

- Determine what to measure. Some metrics may be important to your company, while tracking others may be counterproductive.

- Decide how to collect recruiting data. The simplest way is to use spreadsheets and enter data manually. But, this method is not efficient if you’re working with large datasets. To make things easier, it’s best to use analytics software or your ATS to store and report on data automatically. You could also import data from these systems to spreadsheets when needed.

- Identify which calculations to do on your own. For example, your ATS can report on your time to fill or recruiting yield ratios, but it can’t calculate your average cost per hire.

- Collect the formulas. Find the formulas and decide the time frame within which to calculate different metrics. For example, you may choose to calculate new hire retention rates annually, but decide to track your source of hire on a quarterly basis.

To get you started, here are the most common formulas you can use for recruiting metrics that matter:

Common Quality of hire formula:

– QoH index = (PR + HP + HR) / 3 where:

PR: Average job performance of new hires (e.g. 80 out of 100 based on quantifiable targets or hiring managers’ feedback)

HP: percentage of new hires reaching acceptable productivity within a determined period

HR: new hire retention rate after a year

See more about calculating quality of hire.

– Cost per hire formula:

CPH = (Internal recruiting costs + External recruiting costs) / Total number of hires

See more about calculating cost per hire.

– Common Time to fill formula:

Time to fill = Number of days between opening of a position until candidate accepts the job offer

For average time to fill, you add all times to fill from different positions and divide them by the number of positions.

See more on calculating and benchmarking time to fill metric in recruiting.

– Offer acceptance rate:

Offer acceptance rate = Number of offers accepted / Total number of offers %

See more on calculating offer acceptance rate.

– Common qualified candidates per hire formula:

Qualified candidates per hire = average number of candidates who were found to be qualified in each hiring process after the initial screening phases (e.g. screening call, resume screening)

See more on benchmarks for qualified candidates per hire.

If you’re interested in more detailed recruitment metrics examples and benchmarks, check out our complete guide.

What recruitment metrics should matter most to a Talent Acquisition team?

Corporate recruiters can use almost every metric to help them improve the recruiting process, though some recruiting metrics will be more useful than others.

Here are examples of the best metrics for recruiters:

- New hire turnover rate or new hire length of stay. New hire turnover rate measures the percentage of new hires who leave your company before their onboarding period ends (usually three to six months.) If you compare turnover rates over time, you can pinpoint when there’s an issue and look into your onboarding or candidate screening processes. Also, many recruiters measure their success according to the length of time a new hire stays with the company.

- Candidate experience scores. Candidate experience is an essential part of building a good employer brand. Companies can benefit from setting up candidate surveys to discover what candidates liked or disliked about their recruiting process. As a complementary metric, track hiring manager satisfaction with the hiring process, too.

- Qualified candidates per hire. This metric measures the number of candidates who made it past the first stage of your hiring process. This metric shows how effective your sourcing and advertising techniques are in attracting the right candidates.

- Offer acceptance rate. This metric expresses the percentage of candidates who accepted a job offer. If this percentage is low, Talent Acquisition teams may need to rethink what candidates want or how competitive their job offers are.

Recruiting teams can track many more metrics. Ultimately, what you choose to measure depends on your company’s unique goals and needs.

Which metrics should matter most to an external recruiter?

External recruiters are usually evaluated on two fronts:

- How quickly they provide candidates.

- And the quality of the candidates they bring in.

Tracking quality of hire and time to fill over time can help recruiters determine whether they are delivering value to their clients. For example, if their time to fill starts increasing, then they may need to revisit expectations with hiring managers or try new sourcing techniques.

What hiring metrics should matter most to HR?

The HR department has a common strategy and budgets for every function, including recruiting. A VP of HR needn’t delve into the mechanics of the recruiting process, but they are likely interested in metrics that indicate recruiting success. Those include:

Source of hire measures how many qualified candidates or hires each recruiting source brings in. HR needs to know which sources are most effective in a given period (e.g. a year), so as to rethink its partnerships and external spend.

Which recruiting metrics matter most to the CEO?

CEOs are interested in the strategic impact of recruiting. Metrics that are concerned with business value and promote action are the most useful. For example:

- Quality of hire. This metric encompasses performance and retention rates of new hires. Retention and high performance increase revenue and are important on a strategic level.

- Actual hires to hiring goals. This metric shows what percentage of hiring goals hiring teams met. It indicates how well the entire recruiting function works.

- Diversity goals. This metric measures what percentage of diversity goals were met or the percentage of diverse hires. If increasing diversity is an important company objective, then this metric can say a lot about your company’s success.

What metrics should I track when working with an external recruiter?

When working with external recruiters, you can still use corporate recruiting metrics (e.g. actual hires to goals), but you should also think about how you’ll specifically measure the external recruiter’s success. Usually, you’ll want to ensure that they provide quality candidates as quickly as possible. You could measure:

- Candidates to interview (e.g. percentage of recruiters’ candidates who were invited to a first or second interview.) If you’re working with several recruiters, compare their scores. Those who deliver consistently low numbers of qualified candidates may not be the best match for your company.

- Time to fill. If your recruiters manage more phases of your hiring process, instead of just providing you with resumes, then time to fill is important to track.

How do I increase the number of job applicants?

If you need to bring more candidates into your talent pipelines, aim to attract more people to your job openings and encourage them to apply. To achieve both of these goals, you could:

- Advertise in both niche and mainstream job boards.

- Enhance your sourcing by using various techniques (e.g. social media recruiting, Google and Boolean search.)

- Hire a recruiting agency that will provide you with qualified resumes.

- Create a short, straight-forward and mobile-optimized application process.

- Ensure your careers page has useful information for candidates (e.g. benefits, culture, perks.)

How do I increase the number of qualified applicants?

Here are ways to attract more qualified applicants:

- Advertise in niche job boards or websites to target a specific audience.

- Write detailed and complete job descriptions to clarify your requirements.

- Add qualifying questions in your job application forms. Your Applicant Tracking System (ATS) can automatically disqualify candidates who don’t answer important questions.

- Conduct screening calls to ensure that only qualified candidates will advance to your assignment and in-person interview stages.

- Enhance your sourcing. When sourcing passive candidates, only contact those who are fully qualified for the job.

Introduction to Recruiting Email Metrics

What are recruiter email metrics?

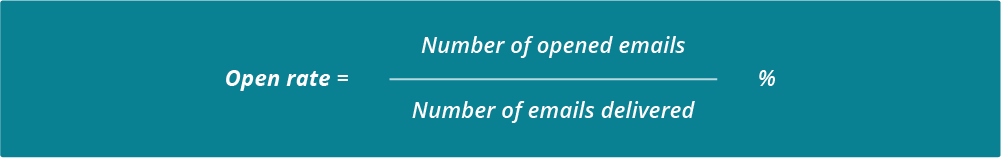

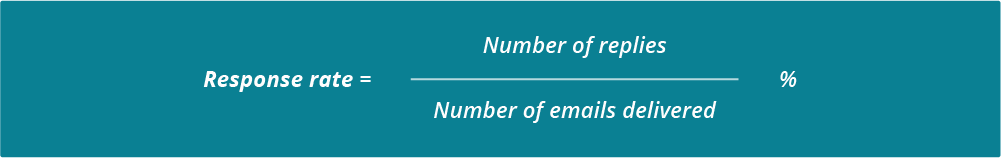

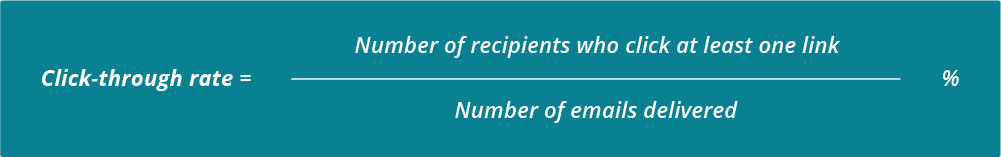

Recruiter email metrics measure the impact that recruiters’ emails have on candidates. If your emails are attractive, informative and aimed at the appropriate candidates, then candidates are more likely to open, click though and reply to them. Here are four recruiter email metrics:

- Recruitment email open rate: Percentage of (delivered) emails that candidates opened.

- Recruiting email response rate: Percentage of emails that candidates replied to.

- Recruitment email click-through rate: Percentage of recipients who click at least one of your links in an email.

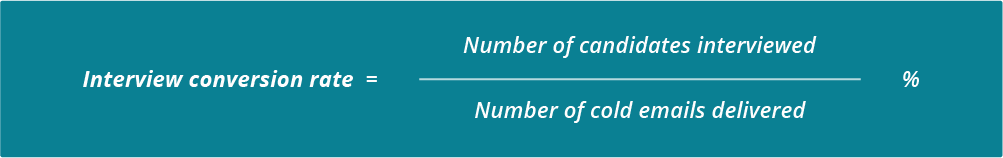

- Recruitment email conversion rates: Percentage of emails that translate into a desired action (e.g. recruitment emails that result in interviews.)

How do you measure recruiter email metrics?

| Email response rate | You could collect the data manually. For example, if you sent 20 cold emails and interviewed five candidates as a result of those emails, your email-to-interview conversion rate is 5/20 = 25%. |

| Email conversion rate | |

| Email open rate | You could use dedicated email tracking tools (e.g. Hubspot Sales, Newton.) These tools notify you when a candidate interacted with your email (e.g. opened your email, clicked on a link or viewed an image.) |

| Click-through rate |

Just count emails that were delivered, since candidates can’t respond to emails they didn’t receive.

More Recruiting Metrics FAQs:

Frequently asked questions

- What are some of the top key recruiting metrics?

- The most important recruitment metrics are time to fill, process step waiting times, and candidate net promoter score. The average length of stay in an interview room for a new employee can vary depending on the organization.

- What is the recruitment Matrix?

- HR managers use a recruitment matrix to estimate potential employees' abilities and skills. This is usually shown as an Excel spreadsheet or other product with data input into it, which then provides estimates of how well each candidate would perform based on what they're assigned to do during their interview process.

- What are staffing metrics?

- Staffing metrics can be used for various purposes, from analyzing recruitment and hiring costs to measuring turnaround time. One common type is the measure of how long it takes an employee to get hired or trained- this would typically involve looking at things like populated job ads versus filled roles.