What is time to fill? KPIs for recruiters

Applicant tracking systems provide an abundance of data to look at, but what metrics should you be tracking? Each business has different needs, but one of the most common and important recruiting KPIs is the average time to fill.

What is time to fill?

The definition of time to fill is the number of days between the publication of a job and getting an offer accepted.

Time to fill can be:

- A critical metric to inform more accurate planning

- An indicator that your job advertising isn’t working

- An early warning that you’re not sourcing fast enough

Firstly, time to fill should never be confused with time to hire which tracks the time elapsed between a successful candidate’s first contact (whether they apply or whether you source them) to their eventual hire. This might seem like a small difference; it’s not. One metric is a reality check for how long the whole process is taking, the other tells you how fast you move once you’ve found the right candidate.

What’s the value of measuring time to fill?

Time to fill metrics should:

- Be informed by your company growth and hiring needs

- Impact your time and recruitment budget

The main function of time to fill is to inform realistic business planning. Far too often, ambitious companies run into problems by underestimating the time it will take to complete the entire hiring process from opening a job vacancy right through to getting an offer accepted. This underestimation can throw off growth plans and slow companies down. At Workable, we need to grow our customer success team in concert with our customer base. Just as we focus on getting accurate growth forecasts for our business, we need to an accurate read on the average time to fill a position. Company growth should inform time to fill.

“Since we forecast our revenue growth, which correlates with the growth in demand for support, we need to be proactive in hiring,” says Workable’s VP Operations, Thanos Markousis. “This lets us get started in time to have the new person in place and fully trained by the time the customer support load outpaces the existing team.”

What’s the average time to fill a position by country?

The temptation with any benchmark is to optimize against it. But this can be a mistake. Most employers would like to see their average time to fill trending downwards but hiring is complex, and optimizing against a complex metric can be damaging.

The DHI-DFH Vacancy Duration Measure, a time to fill measure for the whole U.S. labor market, hit a record high of 29 days in January 2016. This figure has been climbing since the financial crisis peaked and reflects falling unemployment and a tightening labor market. This is not a context you can necessarily beat. In other words, you may not be able to lower this number but you can learn to budget time more effectively in planning your hiring.

Similarly, putting excessive weight on time to fill metrics by industry can be misleading. To verify this, we looked at Workable data on several key industries. In the graphs below, you can see the variances in time to fill between different roles in each industry:

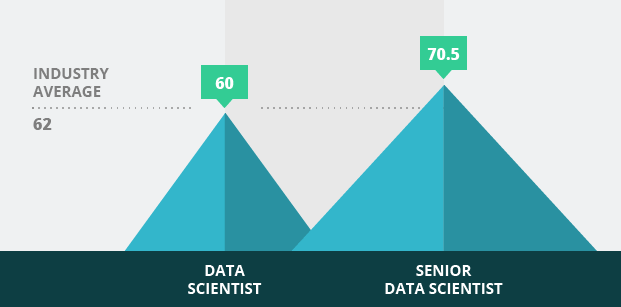

Data Science

While the industry average time to fill for data science positions was 62 days, some roles had lower numbers, like data scientist with 60 days. Meanwhile, hiring a senior data scientist was taking 70.5 days on average.

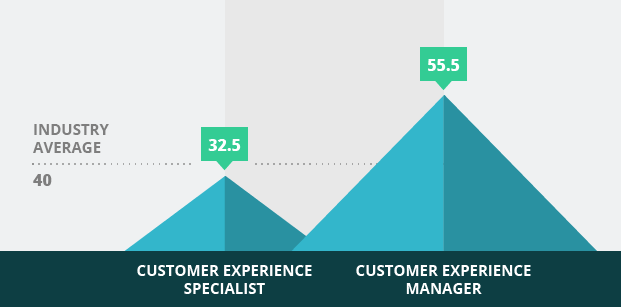

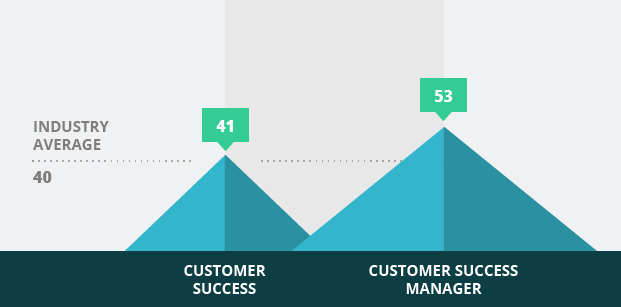

Customer Experience and Customer Success

A customer experience specialist job took on average 32.5 days to fill (less than the industry average of 40 days), whereas hiring a customer experience manager was taking 55.5 days. We can see similar variances in the field of customer success:

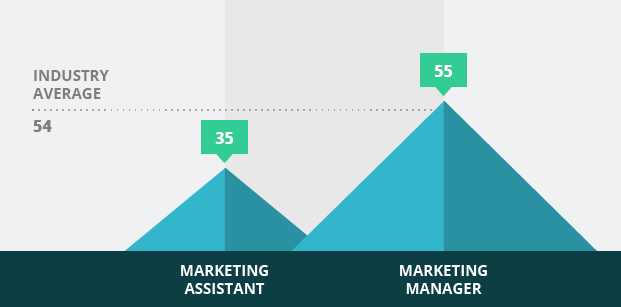

Marketing

In the marketing industry, we can see the wide variance between junior and senior roles. While hiring a marketing assistant took an average of 35 days, much lower than the average, hiring a marketing manager was taking 55 days.

More: FAQs about time-to-fill and time-to-hire

How to improve your time to fill

If your time to fill is trending upwards or appears completely out of synch with industry peers and local competitors here are some concrete steps you can take now:

- Break the metric down by department. This will help you see where the slowdown is happening. This may be due to external factors like a poor supply of java developers skewing the overall picture

- Remove any constantly open positions you have from your overall average. If you’re always hiring for sales reps and leave the position open, then the numbers for this job will adversely affect your time-to-fill.

- Look at how many qualified applicants you’re receiving. If too few of your applicants are making it from sourced and applied through to a first screening call, you may need to revisit your sourcing and advertising strategies.

Recruitment KPIs that matter:

- Time to hire: The efficiency metric

- Cost per hire: Use our calculator to calculate and benchmark hiring costs

Use the right recruitment KPIs to get more signal and less noise. Read our recruiting metrics FAQ.