Key hiring metrics: Useful benchmarks for tech roles

Key hiring metrics for the tech industry include time to fill, qualified candidates per hire, and interviews per hire. These metrics provide insights into the efficiency of the hiring process, the quality of candidates, and the effectiveness of interviews. Regular evaluation of these metrics can help improve hiring strategies.

How does your tech recruiting process compare to that of other companies? You may know your own key hiring metrics like your average time to fill or how many qualified candidates you need to make a hire, but what’s the significance of these numbers?

As Hung Lee, CEO & founder of workshape.io and curator of the popular newsletter Recruiting Brainfood, told me: “I have no idea what a number means unless I have something to compare it with.” That’s something most of us usually think about percentages or figures; how do we know those numbers are low or high, or whether they’re good or bad?

So, to help you determine how effectively your company hires for tech roles, we’ve created benchmarks of key hiring metrics based on anonymized data from millions of candidates processed in our system. By comparing your own numbers against these benchmarks, you can determine what areas of your hiring process are normal and what areas need optimizing.

Contents

Time to fill

Time to fill is the amount of time you need to fill a position. Essentially, you count the number of days between publication of a job and having a job offer accepted. Our system is designed to measure time to fill by default.

Workable also measures a complementary metric, time to hire, which is sometimes used interchangeably with time to fill. Time to hire is the time elapsed between engaging a candidate and them accepting your job offer. This metric tells you how fast your hiring team was able to identify the best candidate and move them along the hiring pipeline.

So, time to fill will aid the process of creating a hiring plan, while time to hire will help you identify bottlenecks in your hiring process. Here are the average metrics for all IT and Development/ engineering roles (including developers, engineers, QA and data scientists) by location:

| Location | Time to fill | Time to hire |

| Global | 68 | 33 |

| US & Canada | 56 | 33 |

| UK & Ireland | 56 | 28 |

| Europe | 85 | 36 |

| Australia | 46 | 28 |

| Asia | 92 | 36 |

| Rest of world | 64 | 32 |

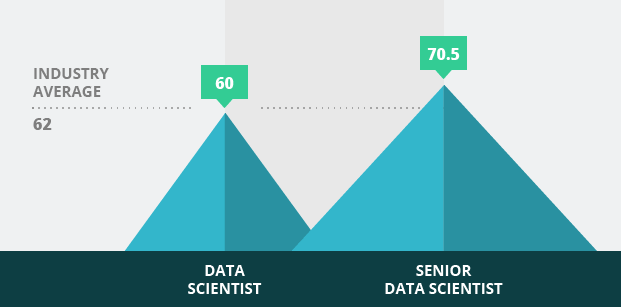

For individual roles, these numbers can be quite different. For example, while the global average for all tech roles is 62, hiring a data scientist takes 60 days on average, while hiring a senior data scientist takes 70.5 days.

Qualified candidates per hire

This metric is part of the overall group of metrics called recruiting yield ratios. These key hiring metrics indicate how many candidates you need at each hiring stage to make one hire.

While each hiring process is different, it’s useful to have an idea about the number of candidates usually needed to make an informed decision. This helps you determine whether your sourcing or advertising strategies work (e.g. whether you advertise on the right job boards or write effective job ads), as well as whether your employer brand attracts the right candidates. If, for example, you have consistently fewer qualified candidates than the average, consider auditing your hiring strategies.

For the qualified candidates per hire metric, we included those candidates who passed the first hiring stage. This means that we counted candidates who were shortlisted after they applied or were sourced (they usually moved on to screening calls).

Let’s dive into the numbers for tech roles:

| Location | Qualified candidates per hire |

| Global | 39 |

| US & Canada | 34 |

| UK & Ireland | 27 |

| Europe | 31 |

| Australia | 64 |

| Asia | 45 |

| Rest of world | 42 |

These numbers shouldn’t be taken as absolutes; for example, if you have only 15 qualified candidates, yet you feel really hopeful about some of them, you might not need to look for more.

But, if you have 10 candidates and the average qualified candidates per hire in your region is 24, consider whether you can make an informed choice with your existing pool or whether you should expand your options by re-advertising or sourcing more candidates.

Interviews per hire

Our system calculates this metric by taking into account how many candidates had calls or interviews hiring teams do before they hire someone. This can give you valuable insight into how much time you’re spending on interviewing.

Here are the average numbers by location for all engineering roles:

| Location | Calls or interviews per hire |

| Global | 12 |

| US & Canada | 13 |

| UK & Ireland | 10 |

| Europe | 13 |

| Australia | 17 |

| Asia | 11 |

| Rest of world | 18 |

Benchmarks show you where you stand in comparison to other organizations, but each company is different. For instance, your golden ratio of time to fill could be fewer or more days than the industry average. Evaluate your process regularly, apply fixes when needed and make sure you use data and a few key hiring metrics to improve your effectiveness and efficiency over time.

Key Hiring Metrics for tech: 5 Takeaways

- “Rest of world” does almost twice as many calls or interviews per hire as the other regions. So, if you can reduce your number of assessments, you may hire significantly faster than the competition.

- Hiring teams in Australia get the most qualified candidates per hire among all regions. This might indicate a very refined recruitment method or the vast availability of tech talent, or a combination of both.

- EMEA & Asia take the longest to fill a position, while they conduct fewer calls or interviews than other areas. This might indicate that their high time to fill is probably not a product of long assessment stages. If you’re hiring in these regions, you could apply strategies to get more qualified tech candidates (the current average of 22 is relatively low compared to other areas) to widen your pool or identify and improve bottlenecks in other hiring stages.

- Hiring teams in the US & Canada have one of the shortest hiring processes, while getting more qualified candidates on average and conducting the same assessments as Europe. This data could indicate that they make fast decisions about moving candidates through their pipeline. In this case, time to fill can be reduced through advertising in the right places to get good candidates in a shorter time or applying better sourcing techniques.

- UK & Ireland comes second only to Australia in terms of time to fill per hire. They do fewer calls or interviews compared to all other regions, but they take slightly longer to spot and hire the best candidates. So if you’re hiring in UK & Ireland, consider streamlining your screening and job offer processes, as well as training hiring teams to make faster decisions.

If you find these key hiring metrics useful and would like to see more, let us know! Tweet to us @workable or send us a message on LinkedIn about which data you’d like to see next.

Hung Lee provided numerous expert insights for this piece. Subscribe to the Recruiting Brainfood to get a weekly recap of the most interesting, inspirational and useful recruitment content on the Internet.

Frequently asked questions

- How do you measure the effectiveness of a recruiter?

- There are many ways that companies can assess the effectiveness of their recruitment efforts. Still, five key measurements stand out as being particularly helpful in determining how successful certain campaigns were: time-to-hire, cost per hire (i.e., wages plus benefits), qualified candidates versus unqualified applicants, sourcing channel efficiency, and quality hires.

- What is a good recruitment conversion rate?

- An excellent recruitment conversion rate is 8.6%, and your employment brand and marketing efforts are strong!

- How many hires should a recruiter make per year?

- The average recruiter should be able to fill four positions per month with a manageable level of difficulty, or around 50 in total. An exception is one working on mostly entry-level jobs will likely find themselves filling 60-80 annually!