On-demand pay: the pros and cons of earned wage access

On-demand pay offers a transformative approach for employees to access wages instantly, enhancing financial flexibility. By bridging pay cycles and immediate needs, it supports better financial management, reduces stress, and fosters a more productive workforce – but also has potential drawbacks.

In today’s rapidly evolving workplace, employee expectations are driving significant transformations. Among these changes is the rising popularity of on-demand pay, a trend that empowers employees to access their earned wages before the standard payday.

This approach addresses the limitations of traditional pay cycles, which often fail to align with the immediate financial needs of workers. By offering flexibility and control over earnings, on-demand pay is reshaping the employee compensation landscape.

Let’s get into the meat and chaff of all the things you wanted to know about on-demand pay and were afraid to ask.

What is on-demand pay?

On-demand pay, also known as earned wage access (EWA), is a payroll model that allows employees to access their earned wages before the traditional payday.

This payroll feature enables your workers to withdraw a portion of their accrued but unpaid earnings at their discretion, often through a digital platform or app provided by their employer or a third-party service. It can also be a “trickle” of pay into your employees’ accounts on a regular basis with greater frequency than the traditional biweekly / bimonthly / monthly models.

The idea of on-demand pay is to provide financial flexibility, which has a range of benefits for both employees and employers.

Benefits of on-demand pay for employees

There are numerous reasons your employees might like an on-demand pay model. First, on-demand pay addresses the financial stress faced by many workers. When offering on-demand pay, employees are better able to manage their personal expenses on a regular basis. They don’t need to wait until the end of the two-week or monthly cycle for a paycheck as bills pile up.

According to PwC’s Employee Financial Wellness Survey 2023, 28% of full-time employees often or always run out of money between paychecks. Even among those who earn $100,000 or more per year, 15% always or often run out of money between paychecks. On-demand pay would help ease these challenges.

The culture of immediate delivery is a factor as well. Borja Perez, VP at EWA provider CloudPay, told TLNT: “People are used to instant gratification in so many aspects of their lives, and they expect the same with their pay. Instead of waiting for payday, employees want immediate access to the wages they’ve earned.”

“People are used to instant gratification in so many aspects of their lives, and they expect the same with their pay. Instead of waiting for payday, employees want immediate access to the wages they’ve earned.”

The rise of the gig economy and freelance models in today’s working world is also an influence. A more dynamic working environment brings the expectation of more flexible payment options.

People do like it – especially younger generations. According to ADP’s Earned Wage Access study, 59% of millennials put higher priority on a job offer when that employer offers on-demand pay or EWA.

Benefits of on-demand pay for employers

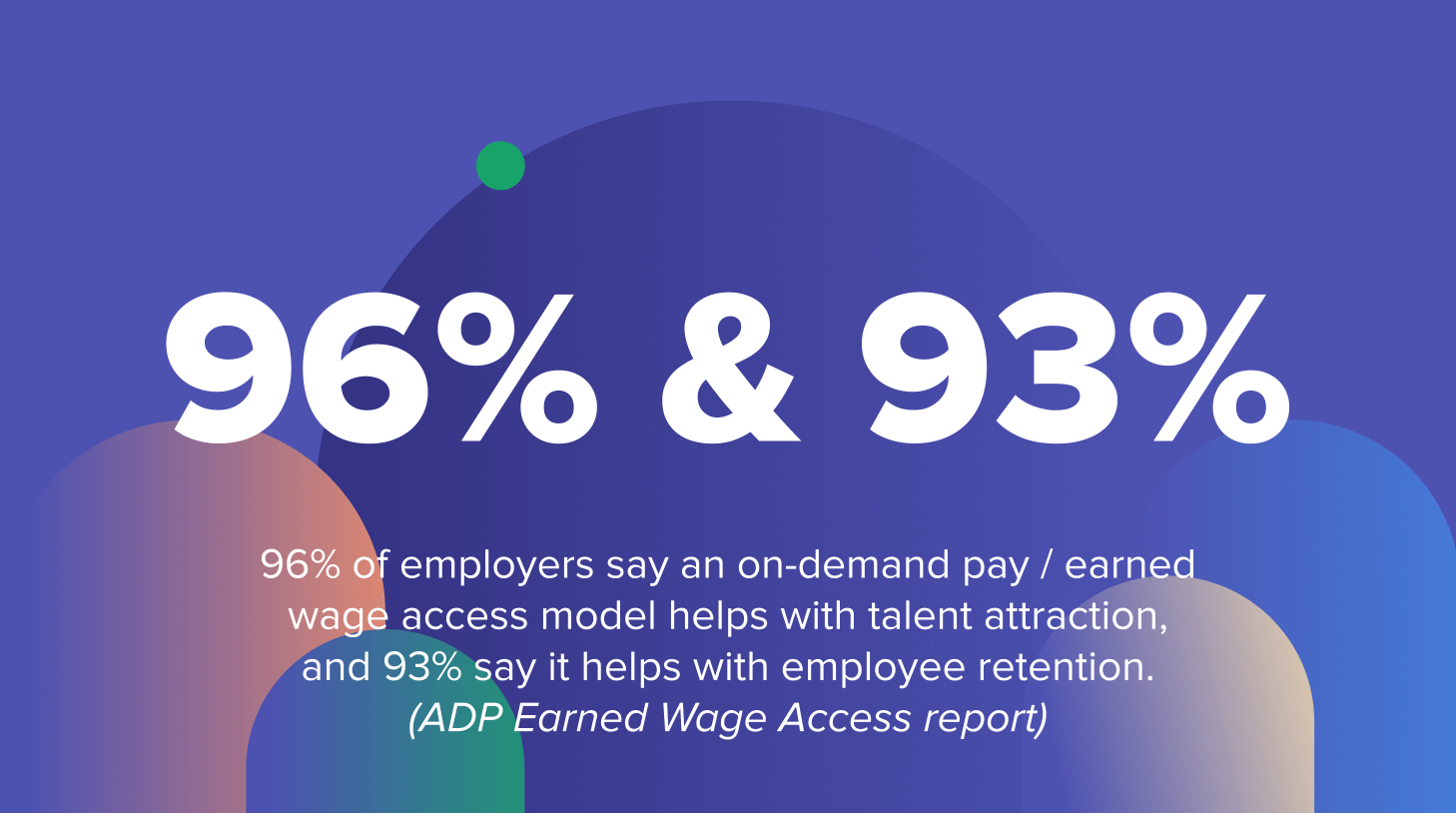

In the ADP study, there’s positive sentiment among employers regarding the business benefits. For instance, 96% of employers offering EWA also find that their employees like it. That same study finds 96% saying it helps with talent attraction, and 93% saying it helps with employee retention.

Also, according to Employee Benefit News, four out of five employers (80%) say EWA improved mental health in their teams, and 88% of business leaders offering EWA saw decreased stress in their employees.

There are intangible benefits as well. By offering on-demand pay, employers can alleviate financial stress, leading to a more focused, satisfied, and productive workforce.

Modernization of payroll processes is also a factor. An earned-wage access model streamlines payroll operations, potentially reducing administrative burdens and costs associated with traditional payroll cycles.

Overall, it can benefit your employer brand, positioning your company as an innovative and employee-centric organization.

The drawbacks of on-demand pay

There are, of course, drawbacks to on-demand pay. It may lead to impulsive spending on the part of employees if they lack financial literacy or discipline. While this falls more on the employee than it does on you as an employer, it’s worth thinking about.

Also, some on-demand pay services charge extra fees, which can add up over time.

And finally, in contrast to the above-listed benefit of reduced administrative work. an on-demand pay model built into an existing payroll system can lead to numerous technical and logistical headaches, at least in the short term.

On-demand pay: an evolution or just a fad?

On-demand pay is gaining traction globally. A report from Zion Market Research predicts a rise in the earned wage access software market from $22.5 billion in 2022 to $26.74 billion by 2030. That same report highlights opportunities in countries with a high rate of daily wage workers where on-demand pay models make sense.

It’s also increasingly legislated. In April 2024, the US Congress advanced the Earned Wage Access Consumer Protection Act to ensure a regulatory framework and establish consumer protections for services that offer workers access to their paychecks before their scheduled payday.

On-demand pay – or earned wage access – could mark a paradigm shift in employee compensation that empowers workers with financial flexibility and control. It could be another ingredient in how the future of work is shaped.

On the other side of the coin, employers are apprehensive about the administrative factors – although with time, practice, and guardrails, these can be resolved.

Employees may also be hesitant because of the implications it might have on their taxes. Those worries may be short-lived as the US Treasury Department continues to update the Internal Revenue Code to clarify tax treatments of on-demand pay models.

What it all boils down to is this: what do your employees want in terms of compensation? And what works best for you as an employer? Weigh out the benefits and risks from an on-demand pay model and act accordingly.

Frequently asked questions

- What is payroll automation and how does it work?

- Payroll automation manages employee payroll with minimal human intervention. It automates salary calculations, deductions, and taxes. It also analyzes patterns, detects anomalies, and predicts future payroll trends with the power of AI.

- What are the benefits of implementing an automatic payroll system?

- Implementing an automatic payroll system comes with benefits like accuracy in salary calculations and deductions, time-saving in payroll processing, minimal errors in HR operations, and enhanced security of sensitive employee information.

- How does AI enhance payroll automation?

- AI enhances payroll automation in many ways; it provides predictive analytics, anomaly detection, compliance monitoring, and personalized employee experience. These features enhance an organization’s HR functions, creating a positive impact on its growth and profitability.

- How secure are automatic payroll systems?

- Automatic payroll systems have advanced security features to protect sensitive employee data, including data encryption, secure access controls, and regular data backups. Hence, payroll information remains protected from unauthorized access or cyber threats.

- What trends are shaping the future of payroll automation?

- The future of payroll automation depends on several trends. Increased adoption of AI, blockchain technology, mobile payroll solutions, and financial wellness programs are some of the most impactful ones. Workable streamlines payroll with artificial intelligence and machine learning. Click here to find out more!