Your Hiring Pulse report for February 2022

In the Hiring Pulses up to this point, we’ve highlighted the ever-shortening Candidates per Hire metric combined with a quicker Time to Fill every month in our network data. It’s an interesting dynamic. What’s going on here?

Now, don’t ask where we got that from – we’re not sure either, but we did hear it somewhere. If you want things to go well, put together a solid framework and put some thought into it first. There’s more there if you want to take a deep dive.

This month, we want to focus on the short supply of candidates that you might be seeing in your open roles. Is that happening elsewhere as well? Oh yes, it is. We’re seeing it in our hiring data. Let’s read on and then look at the ways you can overcome this challenge so you can keep your SMB engines running at full throttle.

How we’re looking at data

First: Data, as a rule, provides us with a measuring stick for comparative purposes, but when that measuring stick changes regularly as is the case in these times, it becomes unreliable.

So, looking at the data YoY or even MoM makes for a flawed study. So, instead, we’re looking at rolling trends. This means we’re showing data as a percentage increase or decrease when compared with the rolling average of the past three months. Jump to the end for a detailed methodology on this.

As always, we look at the worldwide trends for three common SMB hiring metrics:

- Time to Fill (TTF)

- Total Job Openings

- Candidates per Hire (CPH)

In this Pulse, we take a look at these three core metrics, and then we’ll take a broad look at how 2021 looks compared with 2020.

Let’s start analyzing!

Table of Contents:

- Time to Fill

- Total Job Openings

- Candidates per Hire

- What’s going on here?

- 2021 versus 2020

- Conclusion

- The Hiring Pulse: Methodology

Main highlights

The three main highlights for this month’s Hiring Pulse are:

- Employers are hiring faster – and that’s becoming the norm

- There are plenty of candidates out there – but their numbers are diluted across numerous job openings

- Job openings are about to surge in the first quarter of 2022

1. Time to Fill

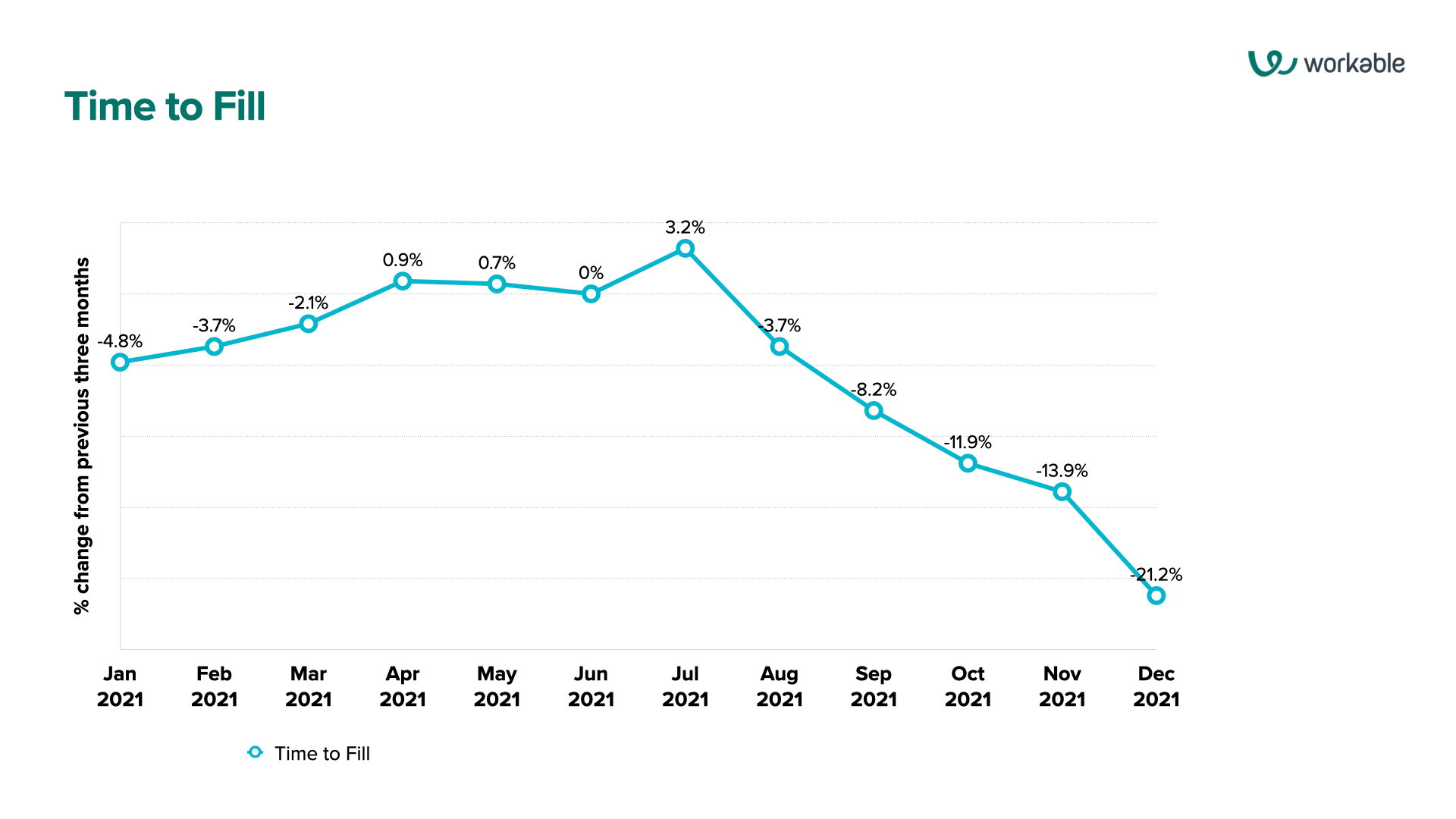

For this report, Workable defines “Time to Fill” as the number of days from when a new job is opened to when that job opening is filled. It’s important that we understand this distinction: if a job is opened in October or even as early as March, but isn’t filled until January, it won’t count in this graph. If another job is opened on the same day in July or September but is filled on the last day of December, it does count in this graph.

While this measurement strategy partially explains the recent downward trend, there’s more happening. Let’s take a look at the TTF trend:

At first glance, this chart really isn’t much different from the ones preceding it – except for one thing: the number of negatively trending months is now five consecutive months.

It was four straight months in last month’s Pulse. And in December’s Pulse, while also five consecutive months, the first two of those five months were only a sliver below zero at -1.1% in June and -1.9% in July. So, really, December’s Pulse is just three months of significantly negative trends.

This time, the first two of the five months are –3.7% and -8.2%, and nosedives after that. What’s the story here? Shorter TTFs are becoming the norm now.

2. Total Job Openings

Total job openings represent the total number of job openings activated across the entire Workable network.

So, let’s look at the raw job open numbers – which aren’t contingent on job open/close dates like TTF and Candidates per Hire, so we can include January 2022 in this chart:

Finally, a reversal in trends: January 2022 shows 17% more job openings than the Q4 monthly average from 2021.

To be fair, December is traditionally a slow hiring season and we highlighted three reasons for that last month: holidays, Omicron, and strategic planning for 2022 – which, of course, includes a hiring plan. Now that 2022 is here, that plan turns to action – including the hiring.

Quick note: The US Department of Labor (DOL) also just announced 467,000 new jobs in the country in January – a full third of which are in the hospitality sector.

The data from past Januaries – even before the pandemic – also show the month to be traditionally strong for jobs. Keep this in mind for later.

3. Candidates per Hire

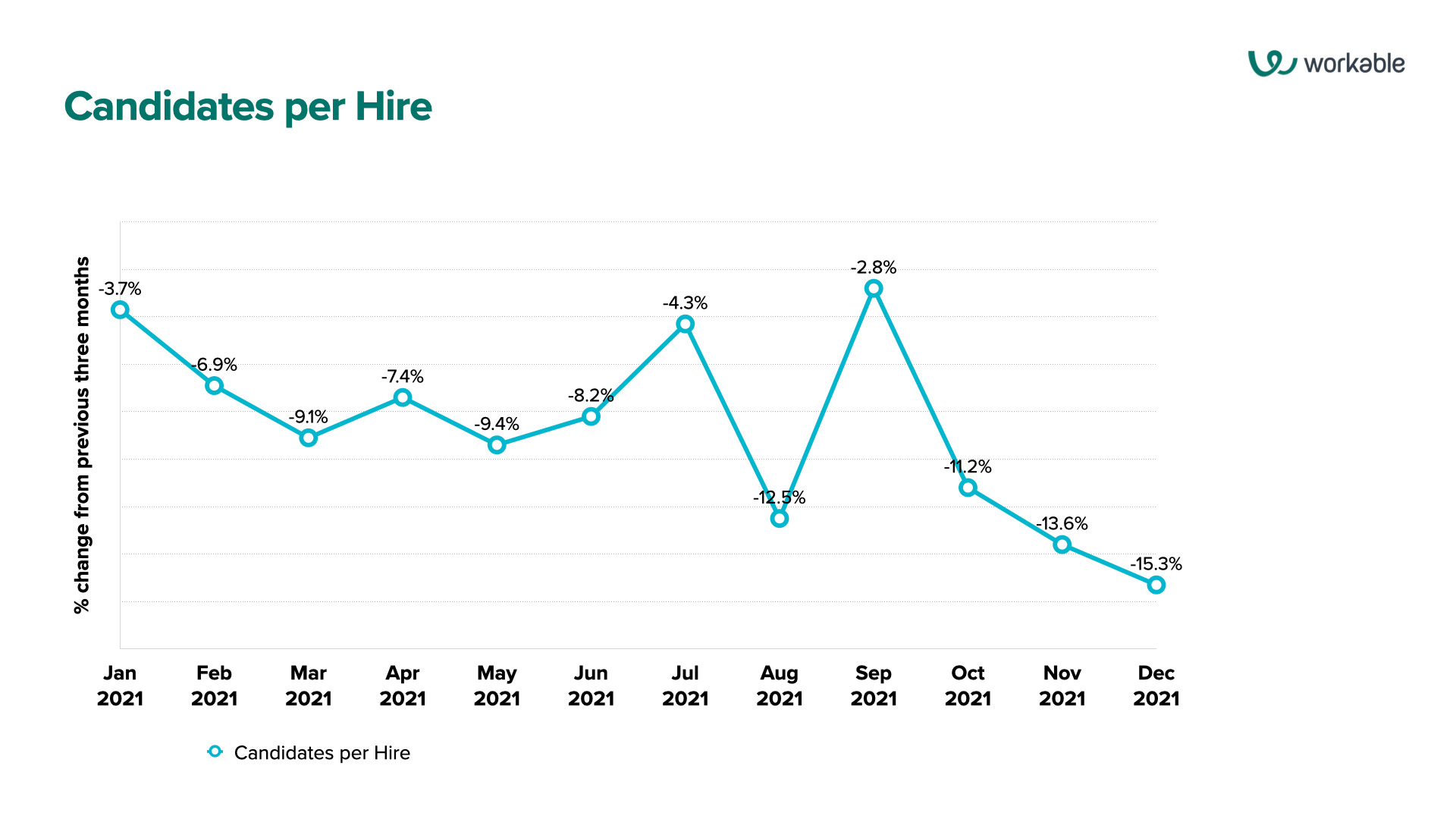

Workable defines the number of candidates per hire (CPH) as, succinctly, the number of applicants for a job up to the point of that job being filled.

Let’s look at what’s going on here through December:

(NOTE: Again, as in the TTF chart, you’re probably wondering why we stopped the numbers in December. Again, as stated above, that’s because these data are based on the time the job was opened, not when it was filled.)

We commented above that employers are really struggling to find and attract candidates to their open roles. This is pretty clear here, with just one positive month in the 17 months since July 2020.

What do we need to say here? There’s no reversal in sight – fewer candidates are the norm.

What’s going on here?

In January’s Hiring Pulse, we highlighted the importance of pre-planning the recruitment process. We’re doubling down on that message here because hires are happening faster than ever.

That’s a good thing for candidates who are (or were) frustrated with long waits for decisions from the employer side. Candidates have a plethora of job openings out there at their disposal, especially now in January. They don’t have to wait around for your next interview or your job offer – they have choices now.

As an SMB employer competing with many other employers for those candidates, you don’t have the luxury of time when evaluating candidates for roles. This means it’s time to get proactive in your hiring process – not only do the prepwork, but also work on your candidate attraction strategy. More on that below.

4. 2021 versus 2020

A debate about 2021 versus 2020 is kind of like debating King Kong versus Godzilla or DC versus Marvel. Both years have been nothing short of eventful, both significant when analyzing via a historical lens, and – closer to our own area of expertise – both come with their own specifically crazy challenges in the world of hiring, far more than anything before the pandemic.

With the full 2021 data at our disposal, let’s take a look at both 2021 and 2020 and how they measure up against each other.

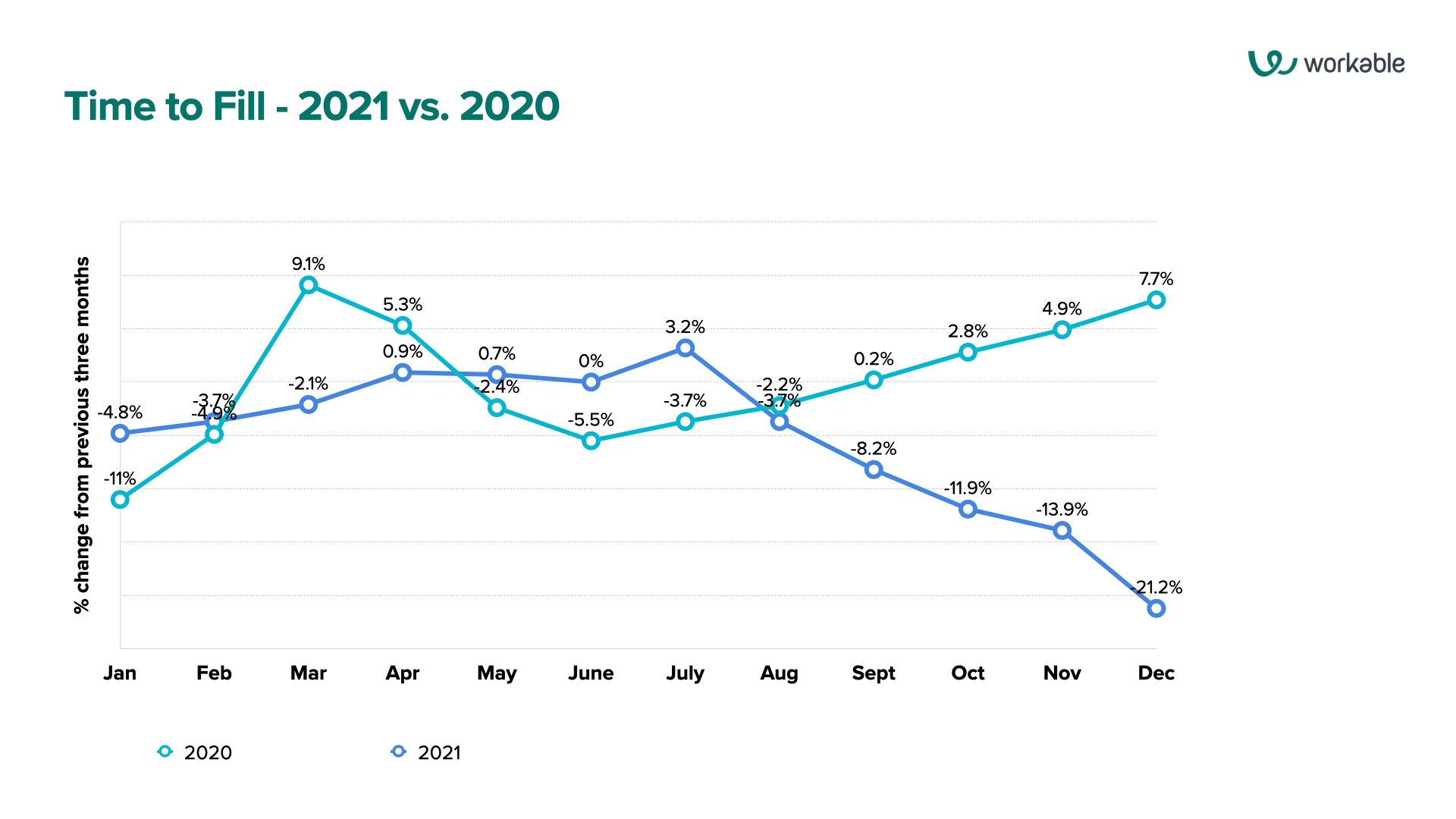

Time to Fill

First, let’s have a look at Time to Fill:

Obviously, 2020 was a whack year for many SMBs. You can see the impact of the pandemic at the start – and the lengthening of the Time to FIll metric (peaking at 9.1% in March 2020) as SMBs held off on hiring until things stabilized. Then, we see some reversal (bottoming out at -5.5% in June 2020) as employers scrambled to rehire and backfill.

Finally, we see the TTF metric stabilize going into Q3 2020 with a mild uptick towards the end of the year.

In 2021, TTF metric looks relatively stable before trending down from August 2021 onwards. This is the Great Resignation at play here – more open roles and fewer candidates are forcing the hand of employers who are desperate to fill roles so they can keep business going.

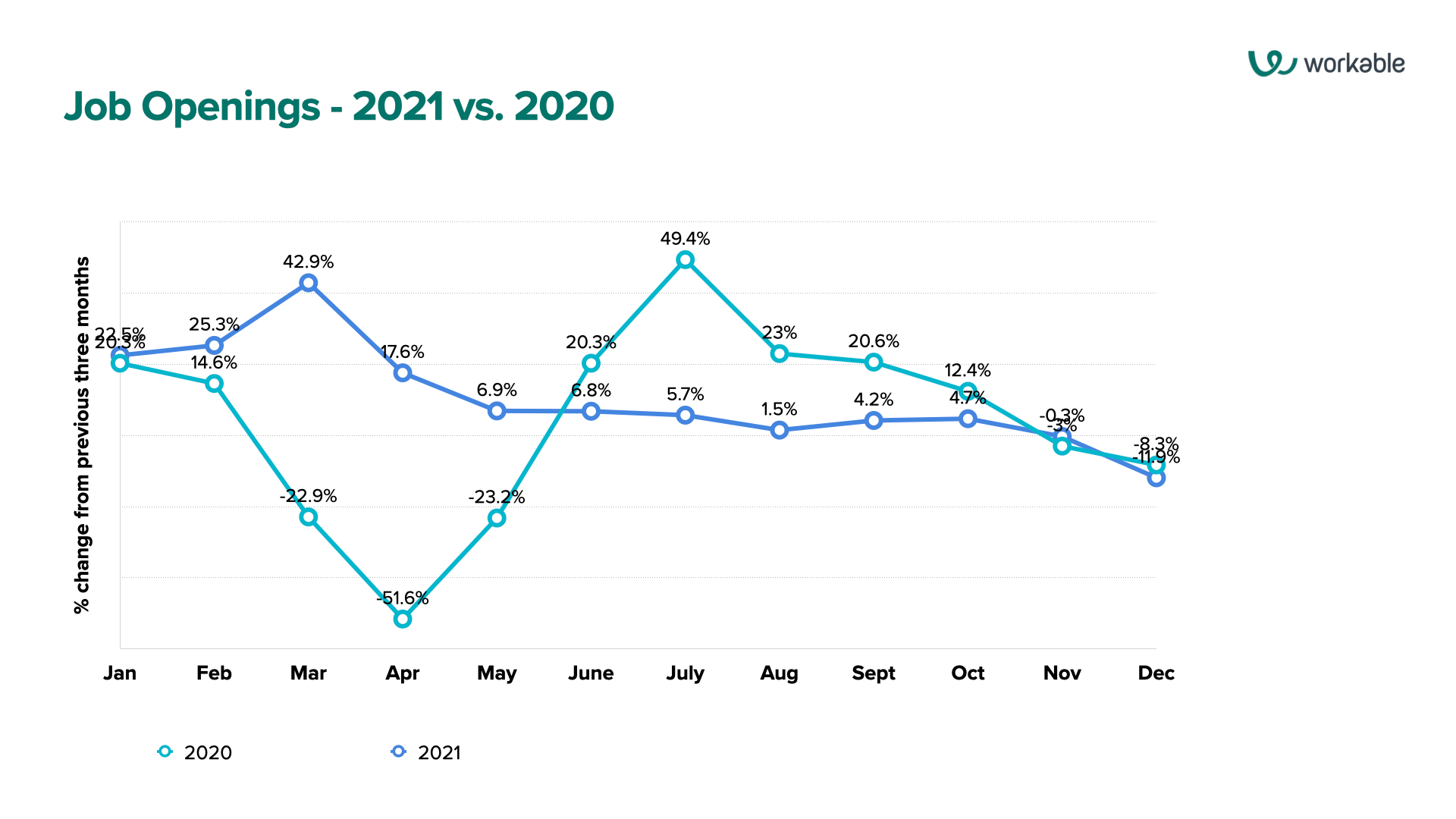

Total Job Openings

Now, the job openings:

Again, you see the impact of the pandemic in early 2020, plummeting to an astonishing -51.6% in April 2020, followed by drastic recovery peaking at an equally dramatic 49.4% in July 2020. Then the job opening trend stays significantly positive until the last two months of 2020.

The other takeaway here is that with January 2020 being at 20.3% and January 2021 at 22.5% – and January 2022 at 17% – job openings get posted en masse throughout January and that’s normal. If the first quarter of 2021 are any indication (22.5% in January, 25.3% in February, 42.9% in March), this will continue to be the case throughout Q1 of this year.

Candidates per Hire

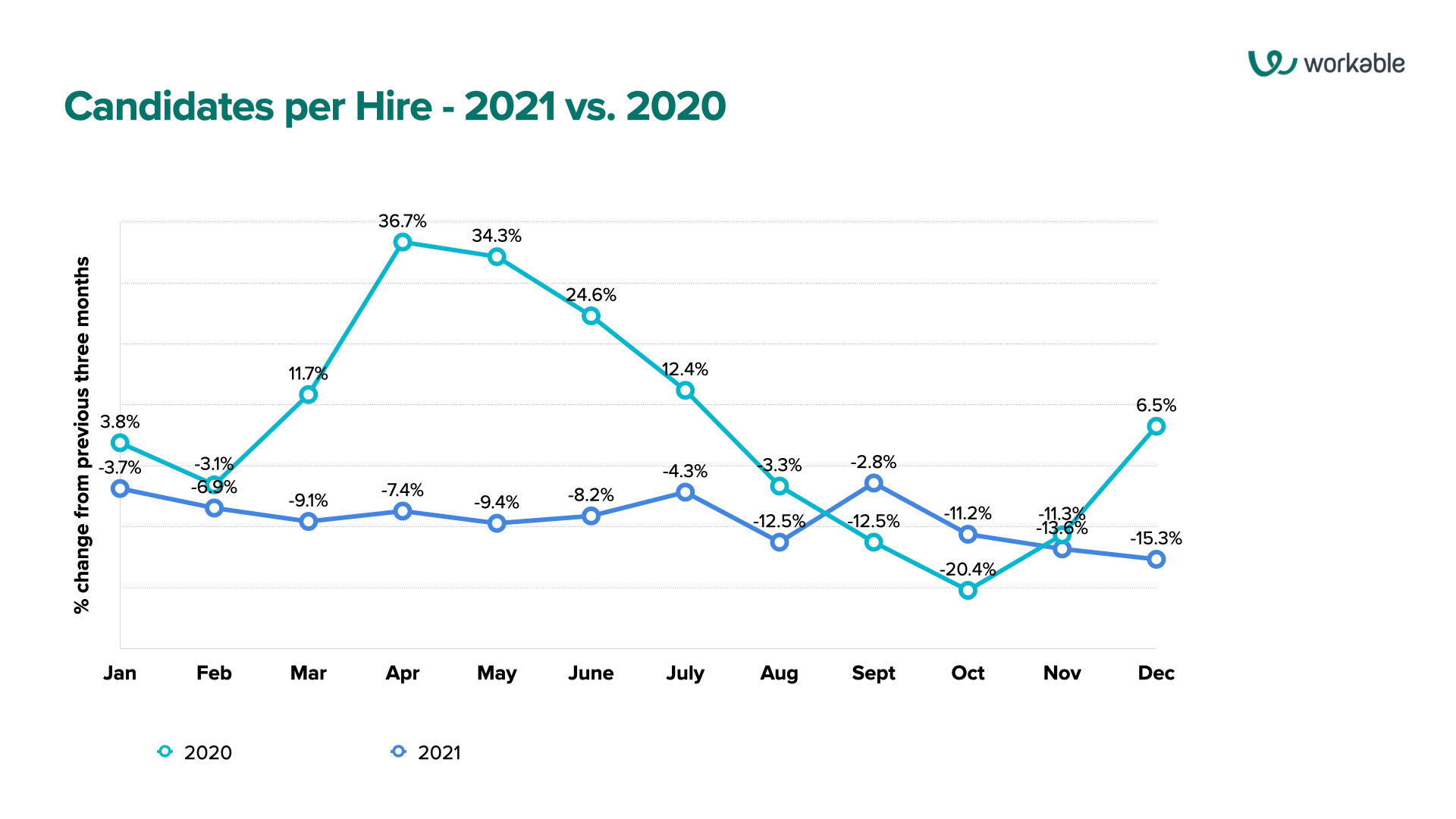

Finally, let’s look at Candidates per Hire for both years:

Huge upturn in the CPH trend, especially in April with 36.7% and May with 34.3% more candidates than the trailing three-month monthly average. The market was flooded with jobseekers in early 2020 due to mass layoffs (correlating with abysmally high numbers in jobless claims from March to May 2020 in the US).

We then see the signs of economic recovery due to the market opening up again through Q3 2020 with a mild uptick in December.

And finally, as pointed out above, the CPH metric keeps trending negative every month throughout 2021 – this is despite Delta and all of the rest of it.

What’s the lesson here for SMB employers? While job openings are relatively normal (so far, knock on wood), the CPH metric is not. There’s very little correlation between 2020 and 2021 here. There simply aren’t as many job applicants per role as there were before.

Conclusion

We’ve already talked about doing your prepwork before posting the job ad as a way to get ahead of that shorter TTF metric.

Now, with candidates at a premium, let’s talk about candidate attraction strategies once the job’s been posted.

The reality is that there are candidates out there. They’re just not applying to your jobs.

There are some factors at play here:

- They’re passive candidates. They’re not actively looking or interested right now.

- They don’t know that you have a job open at your company because they’ve never heard of you.

- They’ve heard about you and that’s why they’re not applying for jobs at your company.

- They’ve seen your job ad and they don’t like your value proposition so they’ve chosen not to apply.

Let’s go through each one by one:

1. They’re passive candidates.

Either they’re working and not looking, or they’re not working and not looking because they’ve found another way to live life. They’ve gone to the farm in Maine and started their online soapmaking business, or they bought a van and are traveling across the country. But that’s not necessarily a forever thing – just a ‘now’ thing.

Or maybe they can’t/won’t work because family takes priority (yes, we found this in our Great Discontent survey – especially for women, who are more than twice as likely to not be working because of family commitments).

But that doesn’t mean they won’t talk to you. But you still need to take the first step of reaching out to those potential candidates. Understand who these people are, and what they’re looking for in a job. Build out your talent sourcing strategies beyond the usual InMail. Establish an employee referral program. One way or another, you need to find them and strike up a conversation.

2. They don’t know about your job or company.

Unless you’re Google or SpaceX, not everyone will have heard of you or your product or service. Or your jobs, for that matter. That means it’s on you to try to get your jobs out in front of people – whether that involves smart distribution or the latest technology.

If you just post to LinkedIn, Glassdoor and Indeed, then you’ll get a segment of candidates who regularly visit those sites. But not everyone frequents those places.

There are numerous places to promote your job opportunities. Think of your job ad as a public announcement. You can’t afford $50 million to get that cherished Super Bowl spot during halftime, but it’s worth diversifying your outreach, whether that’s on niche job sites, via your extended network, through clever marketing campaigns, or even sanctioning an article talking about your company culture – think of it as an investment in your future employees.

3. They’ve heard about you and because of that, they’re not applying.

First off, this is about your reputation as an employer; in other words, your employer brand. Maybe something happened during layoffs in mid-2020 that just shed bad light on you as an employer. Maybe your salaries aren’t up to par with similar roles in other companies and people are talking about it, or you’re known for being inflexible in your work processes.

Or maybe it’s about your company brand. Perhaps your product or service is controversial. Maybe your public messaging or positioning rubs some the wrong way.

First, find ways to build (or rebuild) trust with the workforce as an employer. Maybe it’s doing some PR work. Maybe it’s getting your employees talking more about the good things in your company. Maybe it’s about marketing yourself as an awesome employer (see more below).

And second, you might emphasize something about the company that helps candidates reconcile the company’s priorities with their own. Look at Northrop Grumman, a US defense contractor that built a microsite highlighting technological innovation and creativity as a way to appeal to jobseekers with a passion in that area. Or target candidates who are more aligned with your company’s objectives.

4. They don’t like your value proposition.

Finally – what’s your employee value proposition (EVP)? In other words, what value are you giving your workers in exchange for what they bring to you? Can you pay your employees more? Can you be more flexible in your working setup? Can you offer remote or other benefits? Can you support working parents? And so on.

Study the local talent market and determine what’s competitive there. Understand the trends and developments in the world of work and see if you can evolve your own EVP to meet those expectations.

Overall, recruitment marketing is at the heart of all this. If you can market your company as a place where people *want* to work – and market it to those people specifically – then you can overcome many of the hurdles described above.

Think of it like a funnel.

- Top of funnel: Are they aware of your job?

- Middle of funnel: Are they interested in the job?

- Bottom of funnel: Have they decided to apply?

Marketing types speak very loudly to this stuff. Go talk to them and find out how you can establish a recruitment strategy that makes candidates *want* to work for you, and motivates your current employees to stay.

Thoughts, comments, disagreements? Send them to [email protected], with “Hiring Pulse” in the subject heading. We’ll share the best feedback in an upcoming report. Watch for our next Hiring Pulse in March!

The Hiring Pulse: Methodology

To bring the best insights to small and medium businesses worldwide, here’s what we’re doing with our data: when looking at a specific month’s trend, we’re taking the numbers from that month and comparing it to the average of the three previous months – and showing as a percentage how that month looks in comparison.

For example, if July shows an average Time to Fill of 30 days for all jobs, and the monthly average for the three preceding months (April, May, June) is 25 days, we present the result for July as a 20% increase.

The majority of the data is sourced from small and medium businesses across the Workable network, making it a powerful resource for SMBs when planning their own hiring strategy.