Understanding a pay stub: a comprehensive guide for employees

Are you confused about your earnings and deductions? A pay stub answers all employee queries and acts as proof of income. The hiring and employee management teams use HRIS platforms to keep pay stubs accessible and maintain transparency with the workforce. Let’s learn more about pay stubs.

Pay stub is a wage statement that help employees understand their salaries, deductions, taxes, and more. Employees have many queries about their compensation plans and salary breakups. Put yourself in their shoes and think. Wouldn’t you want to understand your salary structure?

According to recent reports, approximately 133.4 million full-time employees work in the US. Now, that’s a huge number! Imagine if every employee had this burning question – What are paychecks and stubs?

So, let’s get some clarity on pay stubs with examples and sample templates!

Contents

What are pay stubs?

A pay stub is a document or itemized wage statement that provides a detailed outline of the employee’s gross earnings and deductions. It gives employees clarity on their total income through salary, wages, or commission. In a standard corporate setup, it is an integral part of the payroll process.

Earlier, employers gave a physical copy of the pay stub. Now, the process is paperless via a digital medium. Employees can access their pay stubs with a detailed structure on their employee portal. Digital pay stubs bring transparency and avoid confusion on both ends (employee and employer).

Understanding different sections of a pay stub

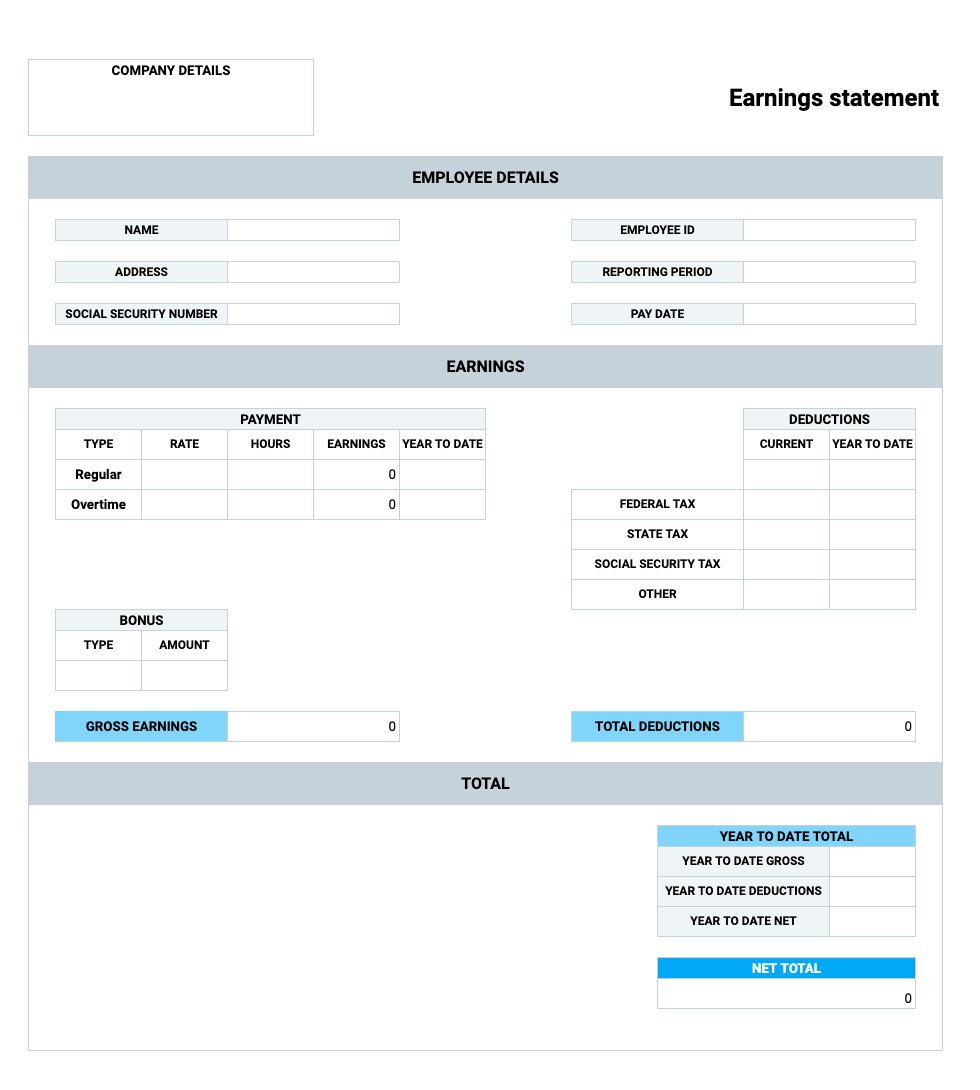

The documented form of the compensation structure contains various sections:

Employee details

It has employee details such as name, address, employee code, social security number, and email address. It establishes the authenticity of the record, highlighting that the payment is made to the candidate.

Employer details

Employer details contain the company address, official email address, and contact details. It ensures the employee’s salary is paid by the employer.

Pay period

Different employers have different pay periods. It can be weekly, bi-weekly, or monthly. This section brings clarity on the payment made for a certain period; the calendar dates covered by the paycheck are mentioned here. For example, the pay stub may have pay dates 01/10/2024 to 01/11/2024 for a monthly pay period.

Pay rate

Pay rate is the number of man hours and the hourly, weekly, and monthly rate for a particular pay period. For a full-time worker, the pay rate is calculated every month. However, the hourly rate is preferred for part-time or contractual workers.

Gross earnings

Gross earnings on the pay stub are the total earnings of an employee in a particular pay period without any deductions.

Deductions

The deductions section on the pay stub includes tax deductions, retirement plan contributions, insurance deductions, and any other contribution the employee has to make per the company policy.

Employer contribution

Employer contribution includes the 401(K) contribution or any other contribution committed by the employer to the employee.

Net payable amount

The net payable amount is the total payable amount to the employee after all the deductions from the gross payment. Simply put, it is the take-home pay of the employee.

Sample template of pay stub

Many platforms offer human resource management software, where organizations can access and manage employee information. They have predefined sample templates for pay stubs for payroll employees.

At this point, it is vital to note that a paycheck and a pay stub are different documents. A paycheck is the total net salary of an employee whereas a pay stub is a document with employee payment details.

Top benefits of using pay stubs for employees

Fair compensation policy

A pay stub is an essential document that contains information about the employee’s pay history. It maintains a clear record of the salary structure with a proper breakup, including gross salary, deductions, and net salary. In case of a raise, the compensation is reflected in the document, which is crucial for employee data management. These days, organizations use employee management software for automatic sync up with the appraisal cycle.

Bookkeeping purposes

An organization has several employees working in different departments. The pay grade of the employees varies based on their job roles. It is important to have pay stubs for each employee for bookkeeping purposes.

Paying taxes

Pay stubs make sure that payroll taxes are paid on time. It is necessary from a legal aspect. They have a clear outline of different components of the salary structure, including tax deductions. Employers can refer to this document for error correction or tax filing.

Uses of pay stubs

For hiring managers/employers

Hiring managers and payroll management teams use customizable sample pay stub templates to record employee details. It is proof of payment by the employer and comes in handy for financial recording and bookkeeping processes. Organizations also use it for tax compliance and other regulations.

You can find many examples of paycheck stubs, ranging from simple to elaborate designs. Check out these free templates.

For employees

Employees use pay stubs as proof of income. For example, they use pay stubs as proof of income to apply for loans and show their income stability. Other than this, they can refer to this wage statement for clarity on their income and deductions.

A payroll processing system makes the process of creating a fuss-free pay stub seamless and easy. HR managers can rely on the system to get an automated pay stub for each employee and maintain transparency on the organization’s behalf.

Workable payroll integration is a game-changer for organizations looking to simplify the pay stub process. It automates data sync and connects with payroll systems such as ADP, Xero, Paylocity, and more. The payroll integration reduces redundancy and errors. It is tailored to the needs of the organization. With great advantages such as payroll processing, tax compliance, seamless integration, and user-friendly portable, it is the best ally of HR.